If you’re in Australia and looking to shop online with buy-now pay-later programs, you’ll know that there aren’t anywhere near as many available options when compared to our American counterparts.

With that said though, there are many more platforms out there than just Afterpay for both customers and business owners, all with their own unique payment options and instalment offerings.

That in mind, we have a list of all the best alternatives to Afterpay in Australia below. If you’re looking for more time than just a month to pay, or after more control of the payment sizes, then these options are you best bet.

Take a look.

Understanding the Buy Now, Pay Later Boom

Before we delve into our alternatives, it’s important that you understand how these services work and the reason behind the pay later boom.

As many Aussies know, there was a Lay-by boom in the early 2000s that brands like Target and Big W as well as Kmart and Myer got in on, which allowed buyers to hold items in the store and make payments toward them. After you reached a specific payment milestone, you were then allowed to return home with that said product.

Fast forward to 2020 and these payment platforms are a lot more flexible and there’s often no waiting period at all. You will be able to have your product delivered, or take it home immediately after your purchase through Afterpay or Zip Pay or anything else. You’ll then work to pay off the instalments while you have the product.

Often called Buy Now, Pay Later or BNPL, these payment systems are becoming common place in just about all stores and industries from general retail through to cosmetic surgery.

All that said, there’s generally little risk and no credit damage coming from using these services, and so long as you pay off your balance in the set period of time, you’re not seeing any interest either.

Zip Pay

At the top of our Afterpay alternatives list is Zip Pay.

One of the up and coming payment platforms, Zip Pay’s popularity is growing exponentially across Australia and you’ll now find the payment platform at just about all of the stores you’ll see Afterpay.

Zip Pay’s method of payment and instalment repayment is a little different to Afterpay, however, in that you’re not breaking up your payments into four instalments but rather setting up a repayment plan that works best for you.

You have the option of a weekly, fortnightly and monthly plan here, and that means you’re able to reduce your payments to a level that works for you — so long as you’ve spent at least $40 in store or online.

There are late fees, though no interest. If you miss a payment or don’t make a payment in an allotted period of time, there’s a $5 or $6 fee depending on which payment you missed.

Klarna

Our second Afterpay alternative is a shopping app rather than just a payment system.

Klarna has recently hit the Aussie market and has a tonne of potential in that it’s incredibly easy to use and works through an app-like shopping experience. You’ll be able to shop through the Klarna platform itself, and that means every product and store you’re seeing accepts Klarna as a payment method.

When you find a product within the app that you want to buy, you simply create your Klarna account and checkout with Klarna. If you’re in a physical store, however, this is where things get interesting.

Klarna can issue a ‘Ghost Card’ in which your purchases are routed through Klarna via your credit card. This means Klarna pays the full purchase price then bills your card for each payment instalment — thus breaking down the size of payments.

To add, Klarna is now part-owned by CommBank and based in Stockholm, so you’re getting a trusted experience here.

The repayment style is a fortnightly-only set up right now, though as we’ve seen on other BNPL payment platforms, this might change in the future.

Zip Money

Not to be confused with Zip Pay, Zip Money is a platform that does charge interest on your BNPL purchases.

This platform primarily works with a specific set of retailers like Officeworks and Kogan, though, there are far larger limits here. That said, if you’re a business owner looking to invest in a range of new furniture items then this is the option for you.

You’re free to spend upwards of $5,000 on Zip Money, which means you have a lot more leeway when it comes to getting more expensive items or furniture pieces for the home or office.

The payment instalments are similar to the other platforms, however, with weekly, monthly and fortnightly payments on offer here.

Zip Money does offer an interest-free period of three months for most purchases, which means you can set up your payments to end with the trial period. However, following this interest-free period you’re getting slugged a 19% interest rate.

The Zip Money system also has a setup fee, which means you might also be paying upwards of $200 to launch your account here.

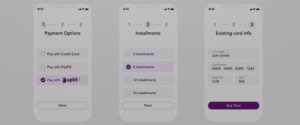

Splitit

Another relatively newcomer to the BNPL market in Australia is Splitit.

The platform is designed to simplify your purchase amounts by dictating the payments and instalments based on whether you’re using a credit or debit card.

For the credit card users, Splitit will authorise payments with your credit lender and ask for approval to withdraw the repayment amounts each month.

For the debt card users, the Splitit system works by authorising the total amount of your purchase for repayment. What this means is Splitit is working to ensure you have the funds available before setting up a repayment plan.

The good news here is that Splitit doesn’t have any fees or interest charges, so you’re free to shop as you like without worrying about administration or management fees eating into your final cost of a product.

OpenPay

One of the BNPL solutions with an ultra-high spend limit is OpenPay.

You’re seeing access to over $15,000 here, as well as support for a bunch of retailers and an interest rate of 0 per cent. There are a few usage-associated fees here for using OpenPay which include the management fees and $9.50 late fees, however, it’s an incredibly low-cost option when it comes to BNPL in Australia.

You also have a lot of freedom here when it comes to repayments, although this is expected with purchase limits up to $15,000.

The service will dictate your payment timeline, which will be between 2 or 3 months up to 6 and 9 months for the larger purchases and all the way through to 2 years if you’ve maxed out your OpenPay expenses. That means you’re getting plenty of time to pay off your account balance.

Sezzle

For the BNPL solution with a fixed timeline, Sezzle is the way to go.

This payment solution works to break down your expenses into six equal payment spreads across six weeks. That said, there should be plenty of time and a low enough bill each week to pay off without worry.

The service is generally supported by electronics retailers, clothing stores and bath and body-related outlets. That said, if you’re looking to pay off your general retail shopping over a six-week period, then Sezzle have you covered.

When you do checkout with Sezzle, you’ll need to pay around 25 per cent of your cart cost upfront and the rest of your balance is then broken down into the six weeks we spoke about above.

There aren’t any interest payments here either, however, there is a $10 fee for missed or late payments, though this isn’t too much to stomach when compared to late fees for credit cards.

Humm

Our final Afterpay alternative is the Big or Little BNPL solution.

A point of difference from Humm is the platform’s auto-categorisation of spending types or habits, and adjusts payments based on this. For example, your expenses through Humm are split into their Big Things or the Little Things spend type, and you’ll have your account adjusted based on this.

To set up Humm, there is an approval process, which means you’ll have to begin your journey here by outlining how much credit you’ll need from them. You’ll then have your account approved and this lasts for 60 days.

When online, in a supporting store, choose Humm as your payment method and checkout. You’ll pay off your first bill at checkout, then the rest is moved to instalments.

The spend limits on Humm are quite large, with Little Things being up to $2,000 and Big Things being $30,000.

Conclusion

With all of those Afterpay alternatives in Australia out of the way, it’s easy to see that there are quite a few to choose from. Whether you’re looking for a retail platform or something a little more professional to invest in office furniture, you’ll have an option.

It’s also good to keep in mind that a lot of these platforms are adapting and changing as we move into the BNPL future, so you may see even more leeway when it comes to repayments or maximum credit limits.

All that said, keep an eye on our website for our most up to date reviews of Buy Now, Pay Later platforms and alternatives to Afterpay.