You can see the leading 2022 beauty trends in most spas, barbershops, salons, Instagram Lives, SMS messages from beauty businesses, and easy-to-use appointment systems.

The beauty and cosmetics industry is fast adapting to new methods and techniques to offer ideas and services directly to customers in response to rising market trends like maintainable cosmetics and celebrity beauty companies.

Much research about spa and salon owners and customers has been conducted to uncover the top beauty market dynamics influencing these professionals’ future actions. Professionals in the beauty industry and proprietors of unique businesses in the Square were also interviewed.

Most of the studies found that experts in the beauty industry employ integrated beauty solutions to meet the varied demands of their companies, including client communication, omnichannel experiences, in-person and online ordering, and contactless payments.

This list of the top trends in the cosmetic industry can help your company gain an edge in 2022 and beyond, whether you manage a cosmetics line, offer skin care goods and services, or own a chain of hair salons. Let’s get started!

10 Amazing Stats in the Australian Cosmetic Industry

- In 2021, it was anticipated that the beauty sector in Australia would generate total revenue of $7,756 million

- Each year, Australians spend roughly $22 billion on cosmetics and personal care items

- Each year, the average amount Australian women spend on the beauty business is around $3,600

- The Personal Care sector is considered the most important and influential in the Australian beauty business

- About 36.1% of all cosmetic sales were executed online over 2021

- As of 2019, 33% of online shoppers for beauty products loved or followed a beauty brand

- Female entrepreneurs and business owners dominate the beauty sector in Australia

- In 2019, the level of employment for physical therapists reached its highest point ever, with a share of 41.8% of the total

- Because of the COVID-19 limitations, the income of the hair salon soared by over 84%

- Almost half of the Australian females (46%) said they would not purchase cosmetics if they discovered that the products were tested on animals

The Overview of the Beauty and Cosmetic Industry in Australia

1. The Worth Of The Beauty Industry In Australia Was Estimated To Be $7,756 Million

After suffering a temporary dip in revenue throughout the 2020 financial year, due to Covid-19, the industry regained its footing in the following year. Although sales reached an astounding $8.601 million in 2022, experts’ projections indicate an even more significant profit rise over the next few years. It is projected that the size of the beauty sector will increase by 3.1% between 2022 and 2026.

(Statista)

2. Each Year, Australians Spend Almost $22 Billion On Cosmetics

The beauty industry in Australia attracts a significant amount of investment and revenue every year. For instance, Australians spent significant amounts on cosmetic imports in 2018, spending a total of $888,405,000 on products abroad.

The Australian economy generates around one billion Australian dollars annually from the sale of cosmetic products and services, which means that a variety of businesses, not only beauty salons and cosmetics firms, can reap the benefits of this growth.

-Mozo, Beauty Packaging

3. Australian Women Spend Roughly $3,600 On The Cosmetics Industry Every Year

About 2.1 million Australian millennial women regularly purchase new skincare products. As a result, women continue to be the primary demographic targeted by cosmetic promo campaigns. Women spend an astounding $15 billion annually on personal care goods, whereas men only spend $7 billion.

Research conducted throughout Australia found that over a million Australian millennial males also use cosmetics products. About 16% of these people constantly purchase cosmetics, although they tend to be more frugal than their Australian counterparts.

Additionally, 16% of males spend money on pedicures and manicures, totalling around $736 million annually, which is still less than the $1.3 billion that women spend on nail care.

-Beauty Packaging,

-Roy Morgan, Mozo

4. Queensland Is Australia’s Largest Market For The Cosmetics Business

Australia is involved in vanity, but most Australians appreciate personal care and attractiveness. The average yearly expenditure in Queensland is $989, making it the most extravagant state regarding beauty. People from NSW (New South) spend the most on beauty goods, 934 dollars per capita, followed by South Australia, with an expenditure of $986 per capita.

-Beauty Packaging

5. Personal Care Is The Most Popular Cosmetics Segment Among Aussies

The income generated by the personal care business has been gradually increasing. The sector reported sales of $3,391 million in 2021, and it anticipates a growth rate of 5.8% over the following four years; thus, it anticipates hitting slightly over $3,737 million in revenues by the end of the 2026 financial year.

In the personal care segment, the items catering to oral and dental health come in second place, with a share of 78%, following closely after those catering to personal hygiene, which has a share of 80%.

-Statista

6. Skincare Revenue Is At $2,112.2 Million This Year, 2022

According to figures for skincare, items that fall under this category get the most attention. They are estimated to earn an income of $1,905 million throughout 2021. In 2021, fragrance revenues were $853 million, and it is anticipated that the industry would expand at a CAGR of 2.37% during the next several years. Cosmetic items fared well, bringing in an expected total of 1,607 million in 2021.

-Statista

7. The Toiletries And Wholesale Makeup Market In Australia Estimated To Worth Is At $8 Billion

According to IBISWorld, in the last five years, the wholesale business for cosmetics and toiletries in Australia has seen significant growth. The analyses project that the revenue will rise to 8.2 billion dollars, demonstrating an increase in income of 2.7%.

-IBISWorld

Beauty Market Overview

8. Over 36.1% Of All Transactions In The Beauty Industry Took Place Online In 2021.

Since 2017, when just approximately 22.5% of people were purchasing beauty goods online, there has been a shift in the number of people buying beauty products online. The figures from the cosmetic business suggest that more buyers are entering eCommerce.

With a market share of 39.8%, more people will shop online in 2022 than ever. Calculations predict an even more significant increase in the number of people buying cosmetics online over the internet as contemporary technology continues to take over, with the percentage of people doing so likely reaching 52.4%.

-Statista

9. Priceline Pharmacies Serve Over 1.2 Million Aussies Women, With Cosmetics Products

Although shopping online is becoming more prevalent in recent years, most Aussies still prefer to buy cosmetics in bricks and mortar shops. Among Australian women, 24.9% shop for cosmetics in supermarkets like Coles and Woolworths, while 23.3% prefer to visit their neighbourhood Priceline pharmacy.

About 14.5% of female shoppers frequent Chemist Warehouse for cosmetics, while 9.8% shop at budget department shops.

-Roy Morgan

10. Online Beauty Consumers Liked Or Followed About 33% Of Beauty Brands In Australia In 2019

Today, the beauty industry uses social media to provide new ways for clients to engage with their spas and salons. Instagrammers, for example, may include book-now buttons in their profiles or make product recommendations in their posts.

Instagram, in particular, is a visual representation of a brand and often the deciding factor for potential clients to schedule a consultation with a business. Studies on the future of the beauty industry revealed that over 19% of consumers booked services through social media, with 37% of salon and spa operators allowing such bookings.

The advent of beauty vloggers and influencer marketing has given social media a whole new significance for cosmetics companies. This is an excellent way for salon and spa operators to demonstrate their cutting-edge industry knowledge and competence.

Most new cosmetics and grooming fads, from “clean beauty” to “at-home manicure kits,” start theirs on social media. They use influencers to demonstrate the latest offerings to their respective audiences and link them to relevant retailers and service providers.

Increased customer interaction is another significant impact of maintaining an active social media presence, which is also suitable for marketing and revenue. According to research, over half of all clients have used social media to communicate with their salons or hairdressers, and almost half of all beauty firms have begun using social media to engage with customers since the epidemic began.

-We Are Social

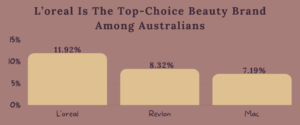

11. L’oreal Is The Top-Choice Beauty Brand Among Australians

Even though there are an ever-increasing number of cosmetic companies, consumers in Australia continue to be loyal to the one that they consider to be their “go-to” brand. A recent poll found that 11.92% of respondents like using products from L’oreal in their beauty routine.

Revlon is another well-known cosmetics brand in Australia; recent research placed it in the second position after getting feedback from 8.32% of the people who participated in the survey. After accounting for the company’s revenue, MAC Cosmetics occupies the third spot with a share of 7.19%.

-Statista

12. Nude By Nature Is A Famous Australian Beauty Brand

Although MAC and Maybelline are household names worldwide, 58.94% of consumers report preferring a different brand regarding cosmetics. According to a study by Roy Morgan in the cosmetics industry, 23% of Australian women who shop for beauty goods prefer to purchase Australian-made cosmetics and toiletries. Naked by Nature ranks first, followed closely by Napoleon and Natio.

To support the animal rights cause, many women in Australia only purchase items made by Australian cosmetics companies.

-Statista,

-Roy Morgan

Employment in the Beauty Industry

13. Most Of The People Who Work In The Beauty Sector In Australia Are Women

In the beauty industry, like in education and healthcare, women are more prevalent than men. According to the results of the most recent poll, women make up 48.81% of full-time workers and 49.79% of part-time employees in the beauty therapy industry in Australia.

The percentage of full-time male workers in the personal care business is just 0.69%, whereas the percentage of part-time male employees is 0.71%. Further figures from Australia’s beauty and hairdressing sector reveal that of the country’s 35,000 enterprises that provide such services, only 3% of the workforce comprises males. This is because women make up 97% of the workforce.

-Statista,

-Women’s Agenda

14. 35.8% Of Australian Beauty Therapists Are Aged Between 25 And 34

Millennials are the most interested in entering the workforce of the beauty business. Currently, 35.8% of Millennials are engaged in beauty therapy. Young persons between the ages of 20 and 24 make up 20% of the workforce in the beauty treatment industry.

-Statista

15. Tafe Institutions In Australia Provided Half Of The Beauty Credentials

In the year 2020, 21,490 people enrolled in beauty courses. According to the AISC, over 55% of students enrolled in beauty programs have a certificate III. TAFE institutions were responsible for 50% of the credentials.

Makeup and beauty services degrees are the most commonly awarded by TAFE colleges. On the other hand, private training providers provide qualifications in areas such as laser hair removal, beauty treatment, and nail care technologies.

-Australian Industry and Skills Committee

16. Over 34% Of Individuals Pursuing Beauty Courses Wish To Secure Employment In The Beauty Therapist Field

According to the study done by the Australian Industry and Skills Committee, the most popular careers in the beauty industry are beauty therapy, make-up artistry, hairdressing, and massage therapy. The most popular employer in the beauty industry is JustCuts, one of Australia’s most prominent franchises.

Enrollment in beauty programs is highest in beauty therapy, which accounts for 34% of all enrollments, followed by beauty services, which accounts for 29%, and makeup, which accounts for 16%.

-Australian Industry and Skills Committee

17. With A Share Of 41.8%, The Employment Rate For Beauticians Reached Its Peak In 2019

After employment levels in the beauty treatment industry had peaked, the Covid-19 questionnaire caused employment levels to plummet to 20.4%. The numbers continued to rise with a percentage of 35.8% the following year, and it is anticipated that this figure will rise to 50.7% by 2025.

-Australian Industry and Skills Committee

Beauty Industry Trends

18. Hair Salon Income Improved By 84% After The Implementation Of Covid-19 Restrictions.

The regulations imposed to control the spread of COVID-19 in 2021 affected consumers’ propensity to spend money in various beauty and personal care industries, including:

- hair care,

- make-up services, and

- massages

More specifically, income at hair salons increased by 84% during the fourth month of the previous year, while income at beauty salons swiftly increased by 112% during the same period compared to 2020.

-Kitomba

19. Over 46% Of Australian Women Would Not Use Beauty Products If They Were Involved In Animal Testing

The public’s attitude toward unethical business approaches in the cosmetics and beauty sector has evolved throughout the last few years. The most recent survey findings reveal that the percentage of Australian women who place importance on a skincare brand’s claim that its products are ‘not tested on animals has increased to 46% from 39% in the previous study.

In 2012, this percentage was lower.

Nude by Nature is committed to producing cruelty-free and vegan cosmetics has contributed to a 61.2% rise in the possibility that consumers will purchase from the company.

-Roy Morgan

Before You Get Your Beauty Sleep

According to data from the Australian beauty business, the market is more robust than ever, even though the capacity of online shopping for cosmetics has yet to reach that of other eCommerce sectors. The industry is on the verge of overtaking other sales channels and creating new opportunities for cosmetic companies.

Such efforts include subscription services for cosmetics, the application of artificial intelligence, and the delivery of customised skincare products.

20. Conversational Commerce Is A New Type Of Ecommerce That Is Gaining Popularity

Maintaining contact and fortifying connections with clients is a top priority for the beauty sector. As a means to keep clients informed, conversational commerce, made possible by automated systems, is growing in popularity among beauty professionals.

The phrase describes a kind of eCommerce that enables companies to interact with clients digitally in real time through apps, chatbots, text messages, or AI agents like Square Assistant.

According to research, more than one-third of beauty salons provide text- or chat-based appointment scheduling. Conversational commerce cannot function without automation, which is why the epidemic has accelerated its growth among industry specialists in the beauty industry.

Before COVID-19, over half (53%) of beauty establishments utilised automated software to confirm bookings through voice communication and text messaging; after the pandemic, 27% of establishments started using the technology.

21. The Omnichannel Booking Option Helps Enterprises Save Time Ana Attend To Clients Online

Making appointments more convenient for customers via digital means has been crucial in cosmetics. Before the pandemic, there was a 55% adoption rate of computerised appointment scheduling technology in the beauty industry, but that number dropped to 25%.

Successful businesses in 2022 may realise the need for a convenient appointment-setting tool that allows clients to choose their timetables. The vast majority (98%) of spa and salon owners surveyed for our Future of Beauty research agreed that using a single app.

These applications can oversee all aspects of their beauty operations, allowing employers to devote more time and energy to direct customer service activities like relationship development. Since it might be one less thing for employees to worry about, a multichannel booking experience has become even more crucial in light of the current labour crunch.

Customers like the convenience of online scheduling tools like Square Appointments because it gives them the freedom to choose their appointments, modify them as required, and be sure that they will be notified on the days coming up to the scheduled time.

22. Salon And Spa Owners Are Expanding Into Retail

The rise of retail as a trend in beauty parlours is undeniable. In 2022, beauty merchants’ most crucial income source remains retail, but they are diversifying into other areas. Over 26% of customers purchased retail items from salons and spas, and more than 25% of beauty firms report that retail sales account for slightly over 50% of total income.

However, if the transition to online and in-store retail is not handled correctly, the resulting increase in competition and profit decrease might be more detrimental than beneficial. Technological advancements simplify salon inventory management in product sales tracking. Streamlining may also be achieved by making cosmetics available online for purchase and delivery.

There has been a recent uptick in the number of online shops opened by the beauty industry. The convenience of purchasing, browsing, and scheduling appointments whenever it suits them best is one of the main draws of an online business. Owners may entice clients to arrange appointments or make product purchases at their stores with the help of a well-designed health and beauty website.

23. Digital Features Help Beauty Businesses To Locate New Markets

Clientele for a salon or spa may come from anywhere. Professionals in the beauty industry are experimenting with video and livestreaming to reach customers in far-flung locations by providing demonstrations of their services, offering advice on improving one’s appearance, promoting their wares, and conversing with viewers.

Over 51% of beauty professionals believe online lessons help engage customers post-pandemic. In comparison, 52% believe that virtual workshops, and 41% believe that Livestream beauty tutorials would do the same.

Offering these additional services allows businesses to tap into previously untapped markets while also satisfying the needs of clients who want to augment their salon visits with the advice they can use at home.

24. Investing In Customer Experience Is Crucial

For obvious reasons, customers’ safety is paramount in the beauty and personal care industry. Nine of ten salons and spas report difficulty meeting COVID-19 safety standards and client expectations for a soothing atmosphere.

Customers are eager to resume their regularly scheduled appointments at salons, spas, and barbershops when they reopen after being closed for the duration of the epidemic. Reopening is especially crucial in the beauty sector, which relies on repeat customers and in-person interactions. Seventy-eight per cent of customers agrees that regular cosmetic treatments are necessary to feel normal.

25. Contactless Payment Is An Essential Aspect Of The Salon Experience

Owners of beauty salons want their customers’ visits to be pleasant and stress-free so they can return to their regular haircuts, makeup applications, and other services. Over 25% of consumers want health and safety-focused beauty firms to accept contactless payment methods.

Regarding accepting contactless payments, the beauty industry has many possibilities. Mobile payments provide easy online or social media booking, allowing clients to pay with their phones.

With an EMV chip payment, users tap their card into an NFC Reader, while with a QR code, they may scan the code with their phone’s camera, enter their credit card details, and pay for the service on their own. And these days, you may pay for your beauty appointment at several locations, not only at the salon’s cash register.

Customers place a premium on contactless payment methods, such as those that allow them to pay using QR codes or their smartphones (like Apple Pay or Cash App). Spas and salons also adopt this payment method since it makes customers feel safe during the outbreak and is simple to use.

FAQs:

1. How many beauty businesses are there in Australia?

IBISWorld says there are 33,520 Hair and beauty and Beauty Services providers in Australia, but other sources say the figure is closer to over 35,000. In 2022, the personal care and beauty market will bring in $6.21 billion. The market is projected to expand by 3.91% each year.

-IBISWorld

-Women’s Agenda

2. Which country has the most prominent beauty industry?

The United States is the largest market for cosmetic products, bringing in over $113,036 in 2022. China takes the second place with $77,961, and Japan comes third with slightly over $53,932

-Statista

3. How much did the beauty industry make in 2020?

In 2020, the cosmetic industry spent $483 billion worldwide.

-Terakeet

4. How much is the beauty industry worth?

By 2025, the beauty industry is predicted to grow at a rate of 4.75 per cent, bringing in a whopping $716 billion.

-Terakeet

5. How big is the beauty market in Australia?

According to the most recent statistics available for the Australian cosmetics industry, the sector quickly recovered from the disastrous impact of the Covid-19 epidemic in 2022, with sales rising by 10.9%.

In Australia, the cosmetics industry generated an anticipated $7,756 million in earnings in 2021. Every year, Australians spend almost $22 billion on cosmetics. Australian women typically spend $3,600 annually in the cosmetics industry. The most significant area of the Australian cosmetic industry is personal grooming.

-Statista

6. What is the beauty industry worth in 2022?

In 2022, the Beauty and personal care industry will generate US$534.000 billion in revenues. The market is anticipated to expand by 5.86% yearly (CAGR 2022-2026).

The Personal Care segment will have a market value of US$241.50 billion in 2022, making it the economy’s largest sector.