Bybit, a cryptocurrency exchange with a global presence across 180 countries, boasts over ten million users worldwide.

One of the reasons for its popularity is that users can utilise the platform without having to undergo identification verification, allowing them to quickly deposit, buy, sell, stake, and withdraw assets without completing KYC procedures.

Additionally, Bybit offers futures trading with leverage up to 100x, further contributing to its appeal among cryptocurrency traders. Continue reading this guide to learn everything there is to know about Bybit!

What Is Bybit?

The contracts that grant you the right to purchase or sell cryptocurrency assets at specific prices in the future are known as cryptocurrency derivatives. Bybit is a trading platform for these contracts in Singapore.

Nonetheless, there are a few points we must clarify before moving on.

Without FCA approval, Bybit is discontinued. It shares your information with other parties inside and outside the EEA. They will share information for marketing and services.

So, how does it work?

You can:

- Take long bets and wager that a coin’s value will increase

- establish short bets and wager on a decline in price

- Leverage up or trade assets with more money than you have in your wallet without holding the underlying item.

- You may profit from the erratic nature of cryptocurrency values by trading derivatives.

- Less hazardous, more convenient nature.

In 2018, Ben Zhou started Bybit, a crypto trading platform. He saw the potential of crypto trading two years earlier. Before becoming CEO of Bybit, Zhou was the general manager for Greater China at XM, a forex brokerage firm.

Zhou gathered a group of experienced professionals from investment banking, fintech, and big companies like Alibaba and Tencent to create the Bybit platform. Today, Bybit has blockchain experts and forex veterans on its team.

Bybit is not the best platform to break into the cryptocurrency market. Instead, use a centralised platform like Coinbase to purchase and sell crypto assets. It might increase your wealth. Making money in trading is possible.

Almost 1.2 million traders utilise the Bybit platform. Many individuals are due to how easily you can understand it. You may acquire the skills necessary to produce money with some practice.

Is it, nevertheless, superior to other trading platforms, like Binance?

The 71 Bybit evaluations on Trustpilot indicate that this trade is typical. The majority of reviewers have given it a negative rating. Nevertheless, given that Bybit’s 2.8 Trustpilot rating system is based on so few customer reviews, it could not accurately represent its usability and trustworthiness.

Bybit Features

Because it offers many practical services and goods, Bybit is a well-liked platform. Bybit provides consumers with a range of services to improve their trading experience. See the list below for a high-level summary of Bybit’s main features.

- Different Trade Types: Bybit provides more trading kinds than any other exchange, including 3 Quick Purchase options, 6 Spot options, and six derivatives.

- Numerous Staking Options: Bybit offers four earning choices, such as double and single-sided staking, for stakes of more than 100 tokens and 50 pairings.

- NFT Marketplace: Purchase and sell hundreds of NFTs on the NFT Marketplace without paying for petrol.

- Crypto Loans: Crypto loans allow you to borrow various cryptocurrencies while pledging one of your current tokens as security.

- Copy Trading: Copy trading is the practice of imitating the trading methods of Master Traders on Bit.

- Rewards Hub: Perform easy activities and earn USD 4000 from Bybit in vouchers.

- BitDAO Incentive Program: Hold Bybit’s native utilitarian token BIT to advance your VIP status and gain access to various incentives through the BitDAO Incentive Program.

- Hold the native utility token BIT of Bybit to increase your VIP level and receive access to several bonuses thru the BitDAO Incentive Scheme.

- 0% Trade Costs on Spot: Bybit is celebrating reaching 10 million customers by removing all fees for spot trading.

- VIP Program: For customers with sizeable monthly trading volumes, there is a VIP program that offers prizes, deals, and coupons.

- Launchpad & Launchpool: Get early access to new coins at discounted costs with Launchpad and Launchpool.

- 24/7 Client Support: Customer service is available around-the-clock in 11 languages, including English, Chinese, Japanese, Spanish, Turkish, Vietnamese, and more.

- Internet Communities: 10+ Join one of Bybit’s ten online communities, which include Reddit, Facebook, Twitter, Telegram, Discord, TikTok, and more.

Is Bybit Regulated?

According to the company’s website, Bybit is established in the British Virgin Islands (BVI) and isn’t overseen by any particular nation or regulatory body. The business asserts that it adheres to BVI regulations and laws and is dedicated to upholding strict security and compliance requirements.

It is crucial to remember that the absence of governmental monitoring does not imply that Bybit is an invalid or unreliable platform. However, before utilising any financial site, including cryptocurrency exchanges, conducting your study and thoroughly examining it is always a good idea.

Bybit Fees Schedule

Users can invest in cryptocurrencies (through spot markets) on Bybit for no cost. This is because Bybit, celebrating 10 million registered customers, charges no fees for spot trading for its members.

Additionally, the exchange provides numerous free fiat money deposit ways (depending on the nation you’re based in), and all cryptocurrency transactions are free.

Also, just a tiny fee (less than $5) is charged for bitcoin withdrawals to offset the cost of gas. The maker/taker rebate for futures trading is the lowest in the world, starting at 0.01%/0.06%, but it turns negative over time as your monthly trading volume increases.

Is Bybit a Safe Cryptocurrency Exchange?

Bybit takes safety seriously and has set up many levels of account security. Its platform complies with the stringent anti-money laundering and client due diligence requirements of Belize’s International Financial Services Commission (IFSC), earning it a license.

Furthermore, it uses cutting-edge SSL encryption technology to guarantee that all website data and conversations are sent securely. User accounts can optionally choose to use two-factor authentication to provide an extra degree of security. Each user’s money is maintained in a multi-signature cold wallet, with 98% of the assets always kept offline. For further advice on account security, see this video.

Bybit is a company registered in the British Virgin Islands called “Bybit Fintech Ltd” for regulatory purposes. They don’t ask their users to prove their identities, even though they are not regulated in any other country. Despite not being controlled, the exchange has never been hacked, and users’ assets are safe.

Bybit Leverage and Trading

You may purchase the following contracts on the platform:

- contracts with inverted time value (BTC-, EOS-, ETH-, or XRP-margined)

- USDT perpetual contracts (margined in USDT (Tether))

- Contracts for inverse futures (BTC-margined).

Let’s go into details:

Perpetual and Futures Trading

When you open a position without immediately swapping the underlying asset, this is known as perpetual trading. You can maintain the work as long as you desire, provided your margin is sufficient.

Futures trading is the agreement to purchase or sell the underlying asset of a contract at a predetermined price at a later period.

The settlement period and expiration date are the two main variations between these two.

Perpetual trading provides greater flexibility to anticipate the settling price and close the service agreement because it has no expiration date. Contrarily, futures trading commits you to a fee for the future and settles at expiry using the spot price.

Inverse Contracts

Inverse contracts employ BTC, ETH, EOS, or XRP to calculate margin, profit, loss, and the US dollar to confirm the transacted quantity. This Bybit amount setting option’s goal is to prevent manually entering Sats.

Perpetual contracts in USDT are quoted and paid in that currency. Because it is a stablecoin tied to the USD, this asset has a benefit. It implies that the firm behind it, Tether Limited, backs its in-transit tokens with equivalent US dollars in reserves. Unlike other crypto-assets, its value has a strong foundation and is less susceptible to speculative pressure.

Although USDT is not without debate, its demonstrated resistance to significant price volatility makes it nonetheless appealing. By February 2021, it was utilised in 57% of all Bitcoin trades. It makes sense why USDT is recommended for novices in several Bybit evaluations.

Another distinctive feature of USDT perpetual agreements is that you may trade any of the other cryptocurrencies using them:

- BTC

- ETH

- BCH (Bitcoin Cash)

- LINK (Chainlink)

- LTC (Litecoin)

- XTZ (Tezos)

- ADA (Cardano)

- DOT (Polkadot)

- UNI (Uniswap)

Leverage

In the Bybit platform, leverage is another option. Using borrowed money allows you to trade more than the actual worth of the assets you hold in your bitcoin wallet.

If the cryptocurrency price follows your expectations, leverage trading may increase profits. On the other hand, if the price moves the other way, it can increase your losses. That can make every Bybit deal you do potentially profitable with some luck and technique. For instance, purchasing 100 futures to long Bitcoin with a 3x leverage indicates that your profit would tremble should its price increase.

Your leverage decision may also determine your first margin to assist you in staying honest. The calculation method used by Bybit to determine the amount of collateral required to create a position is as follows: contract quantity / (order price x leverage).

The Bybit exchange’s risk limit table shows that as the value of the contracts you own increases, so does the maximum leverage. Any notable rise or reduction in contract value results in a predetermined increment adjustment in your initial margin need.

Margins

The maintenance margin is the smallest capital you must have to keep holding a trade. Your initial margin price level moves first, and your maintenance gap price level follows.

There are other ways to manage your gains and losses and risk exposure besides using Bybit tools like stop-loss, take-profit, and hedging. Moreover, cross-margin and isolated margin are options.

The collateral you utilise in a position in isolated margin mode is not connected to the remaining amount in your account. The only margin susceptible to liquidation is the one you set for open trade.

To lessen the likelihood of liquidation, 100% of the equity of the associated trading pair coin is at risk in cross-margin mode. But you will lose everything if the available balance falls below your maintenance margin.

You may configure the leverage with the isolated margins system up to 100x. You can’t manually alter it with the cross-margin method; Bybit determines the leverage by checking your position’s value and the highest amount you may lose.

Moreover, you don’t have to depend on a single Bybit price to safeguard yourself from price gouging. Mark Price, created by fusing the global spot inflation figures and the eroding funding base rate, and Last Traded Price make up the dual-price process used by the firm.

This promotes a more equitable trading environment by reducing price disparity and protecting platform customers from nefarious liquidation.

Bybit Type of Orders

Below are the many order types available on Bybit:

- Limit – Thanks to those, you may control the order price, the number of contracts, and the leverage. They are executed when the most recent Traded Price hits the predetermined order price.

- Market – You may also choose the number of contracts and the order price. But, the completed price is determined by the lowest-priced option on the order book. You may utilise them to join or quit the market rapidly and swiftly respond to the fluid pricing environment.

- Conditional – These advanced bids run automatically when your chosen trigger price crosses the Last Traded Price. In contrast to conditional limit orders, which must wait in the order book while their execution is pending, conditional market orders are filled immediately.

Bybit Deposit and Withdrawals

The five cryptocurrencies that Bybit supports are XRP, XRP, BTC, ETH, EOS, and USDT. By default, you’ll have a wallet for each commodity, but Bybit determines your ultimate equity in BTC.

You can start trading after transferring any of the currencies above you may have stored elsewhere to your Bybit wallets. Just use Fiat Gateway if you’d prefer to purchase cryptocurrency using Bybit.

The Fiat Gateway accepts 45 fiat money, which includes the United States dollar, the euro, the Australian dollar, and the pound sterling, in addition to BTC, ETH, and USDT. These are the only transaction choices available because Bybit does not currently provide a USD wallet.

The site can provide various payment alternatives supported by multiple third-party service providers based on your selected fiat currency. You may choose the vendor who can quickly top off your accounts with the most cryptocurrency for the lowest costs.

Also, you may utilise the Coin Switch, a mechanism for changing one cryptocurrency supported by Bybit into another.

There is a purchasing limit per order to consider, even if no minor Bybit deposit is required. It costs between $20,000 and $15,000.

You must enable two-factor authentication to make withdrawals. In addition, a Bybit withdrawal charge applies.

Bybit Fees

The several forms of fees that Bybit users may experience are listed below.

Funding Fee

Bybit uses its funding method to keep the enduring contractual current value as near the spot market as possible. The interaction of the two prices determines who pays the financing charge.

Long position holders must repay the compensation to directional bias holders if the trading price is higher than the spot price. As a result, more traders may open short positions, which would lower the trading price. The owners of temporary places instead pay the charge if it falls below the spot price.

On the platform, the financing charge is made every eight hours. The settling times are 0:00, 08:00, and 16:00 (UTC) (UTC). The spread between intervals determines the financing rate for a prospective settlement time.

Trading Fees

Bybit operates on a maker-taker paradigm. Instead, the firm offers maker rebates instead of Bybit trading fees.

Your order will increase market depth and create liquidity. You will receive a reimbursement from Bybit. If you take the market, you’ll be responsible for a Bybit trading charge.

With BTC USD, EOS USD, ETH USD, XRP USD inverted perpetual contracts and BTC USDT USDT perpetual contracts, the actual trading costs and maker reimbursements are the same. The taker charge is 0.075%, whereas the manufacturer rebate is -0.25%.

Any rebates and taker fees will impact your account balance, not your starting margin.

Asset Exchange Fee

Bybit exchange costs are fixed at 0.1%, no matter how much cryptocurrency is exchanged.

Asset Recovery Handling Fee

Bybit can assist you in recovering an unsupported cryptocurrency that was accidentally deposited.

The business could be able to credit your account with the USDT it converted your coin into, or it could be able to restore it to its original cryptocurrency wallet. In any situation, you’ll be charged a 20 USDT one-time handling fee for each successful asset recovery case.

The handling cost is set, the same as all other Bybit prices. But, the firm will only assist you in recovering your coin if it is worth a minimum of 20 USD.

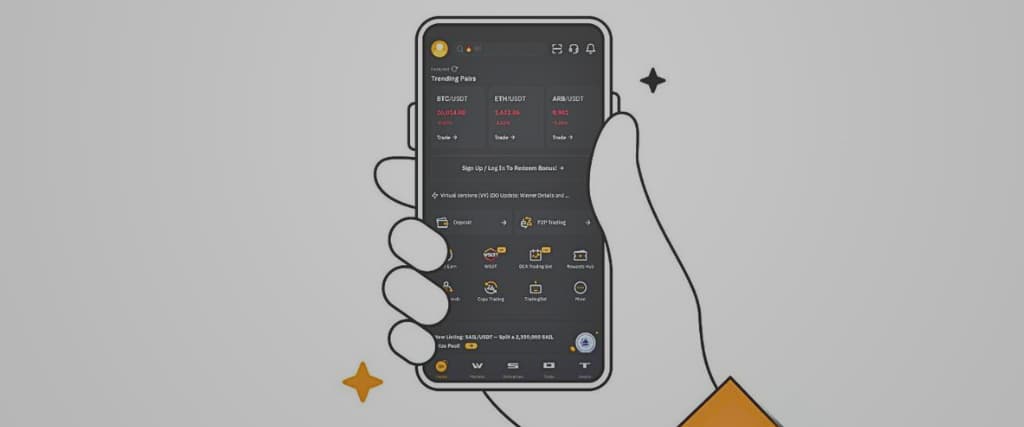

Ease of Use and Interface

Bybit’s trading page may seem frightening to inexperienced visitors. Nonetheless, it’s likely one of the most accessible trading platforms for crypto derivatives to use for someone with trained eyes.

If you study the exchange’s foundations, even a novice user may comprehend how everything operates.

You’ll love the platform’s customisable modules once you’re ready to trade. While the modules may be easily moved, resized, or maximised, the dashboard’s structure is well arranged.

The functionality of the Bybit smartphone app is identical to that of its web-based equivalent.

It has a user interface that is very responsive and simple to use. The leverage slider was a particular favourite. Although you may manually enter a number, this tool makes leverage modification simple.

You may translate the text into seven more languages if you need to speak English fluently, including Spanish, Japanese, Vietnamese, Korean, and Russian. The trading software dashboard is one of many parts that supports several languages. The Bybit Blog, Bybit Learn, and Help Center information may all be translated.

Bybit Affiliate Program

There were a few incentives for first-time deposits of the various assets the platform allowed when this Bybit review was being written.

The “A Huge Bargain” coupon, valued at $50, is one of them. By depositing at least 11800 XRP, 0.1 BTC, 1,390 EOS, 3 ETH, or 5000 USDT within two days of signing up, you can get this Bybit welcome bonus.

You can still receive a $10 Bybit bonus offer beyond that window if you don’t deposit inside it as long as you fulfil any essential deposit criteria. It will be given to you in the coin you deposited in its place.

Also, you may get a $5 Bybit incentive and a $5 coupon if you follow the business on social media and make a BTC payment.

Prizes are available to everyone. Existing users may use several flash sales, tips, and raffles. Thus, to find out which Bybit incentive is available on any given day, check both the Rewards Hub and the Current Promotions page.

You may earn $10 through the Bybit referral program for each new user you convince to join the service. Also, your eligible referees will receive a $10 welcome incentive.

A successful referral requires that the new client you invited:

- Bybit account creation requires the use of your referral link or link.

- Invest some money.

- Conduct at least one deal in a futures contract or an inverse perpetual BTCUSD.

- Just invite them to sign up on the site using your promo link or link to keep asking your potential referees. You may send your invites via a QR code.

Where can you apply your bonuses, then? They work well for trading losses, fee offset, and margin. You can remove the earnings from buying and selling with them, but you cannot withdraw them.

Join their affiliate program if you desire more and longer-lasting incentives for attracting new dealers to the Bybit exchange. You may benefit from lifetime commissions on each new authorised member that signs up due to your promotion.

Bybit employs a two-tiered commission structure. 30% of the platform’s earnings from trades made by your referral and 10% of the profits made by your sub-affiliates are yours to keep. A referral that becomes a Bybit Affiliate is referred to as a sub-affiliate.

Over 10,000 content producers and marketers from 160 countries are already part of the network and get a monthly recurring income split for each new customer. Bybit asserts that their rate is more than 100 per cent greater than the average for the sector and that they’ve already paid out at least BTC 5,000 in fees.

All you need to do to become an affiliate is complete Bybit’s straightforward application procedure. The business will provide you with a unique referral link once you have the go-ahead to share it with your audience on social media, in advertisements, articles, blogs, etc.

Bybit Mobile App

A Bybit smartphone app is available for iOS and Android users to download. On Google Play, the latter has received over 100,000 downloads. Since its October 31, 2019, launch, it has received 2,450 Bybit ratings with an average score of 4.3 stars.

We understood why most traders like the Android app after installing it and experimenting with it for a few days.

The app can perform all tasks that its browser-based equivalent can. There are several displays for:

- contracts

- the price graph

- order book

- recent trades information

- the order zone

- notifications

- Wallets.

Similar to this, the Bybit mobile app offers many strategic alert alternatives. When the Last Traded Price rises greater or lesser than your selected alert rate, you may turn on its widget customisation to get notifications.

Also, you may configure alerts for spikes and drops if the values of your preferred trading pairs fluctuate by more than a specific percentage in five minutes. The same applies to open interest modifications.

The Bybit app also lets you set a reminder for the funding rate prediction for your preferred trading pairs half an hour before funding settlement.

Bybit Security

The CEO has publicly said that because most bitcoin exchanges are centralised, they are destined to become targets for hackers. Is Bybit unique from the competition in terms of cybersecurity?

Absolutely, and compared to the ordinary crypto trading site, it handles cybersecurity more seriously. Let’s examine the steps the organisation takes to safeguard your assets.

Multi-Signature Cold Wallet Storage

Bybit has created a hardware wallet solution to help protect its users’ assets from hostile threat actors by storing them all together in cold storage.

Bybit gives cold deposit credentials to traders, unlike other exchanges that employ hot wallets, online-accessible crypto wallets. Using offline signatures, it accomplishes asset aggregation and withdrawals.

In other words, on the Bybit platform, withdrawal requests are subjected to manual scrutiny three times daily. Although you won’t get your money immediately, this rigorous procedure helps deter hackers. Moreover, you can still take money out of your wallet once every seven hours.

Zero-Trust Architecture

Bybit employs an internal system and a zero-trust architecture to implement software lifecycle management.

Renowned cybersecurity specialists will perform penetration testing that the organisation has recruited. It also adheres to the principle of segregation of tasks and collaborates with an outstanding outside security auditor.

Rigorous background checks, security training, and testing are required for every Bybit employee to avoid insider attacks.

Partnership With White Hat Hackers

Bybit collaborates with white hat hackers to quickly spot cybersecurity flaws to prevent data leaks. With its bounty programs, the business compensates those who find security holes.

Using Two Factors To Authenticate

Bybit supports the use of two-factor authentication for improved account security.

You only have to pass one verification level to enrol on the platform, sign into your wallet, or use Bybit to purchase crypto assets for trade. But, the system will demand that, if necessary, you configure a mix of email or SMS verification and Google Authentication:

- Changing your password

- Make security settings changes.

- Take your money out.

- Also essential for API administration verification is Google Authentication.

Extra Layers of Authentication

Unique security elements are also present in the Bybit phone app. You may turn on the pattern lock and fingerprint recognition for more protection.

However, be aware that Bybit will divulge your information to other parties for legitimate and promotional reasons.

How to Contact Bybit Customer Support

Although Bybit might have a challenging learning curve, several methods exist to seek assistance.

Email and Chat Support

The business provides email and lives chat round-the-clock. Given that they periodically ran across issues when doing the test for our Bybit review, they found both channels helpful. This didn’t surprise us because they weren’t acquainted with the platform before.

On the trading website for Bybit, there is a chat room. Here, other users are prepared to respond to your inquiries. Nevertheless, if you’d like a one-on-one interaction, use the Bybit iOS app equivalent to connect with a customer service representative.

The support staff of the organisation will respond to you right away. Your response might be delayed if there are many support queries. Nonetheless, we guarantee that the wait time will be reasonable.

You must wait for an agent to become available while still on the chat screen. You must stay at the back of the queue if you need help. But you can open a support request in its place if you need more time and your issue isn’t urgent.

Social Media

There are more than eight social networking profiles for Bybit. The firm has accounts on Instagram, Facebook, YouTube, Twitter, Reddit, Telegram, LinkedIn, and Medium, where you may interact with it. Ben Zhou will respond if you tweet him directly.

Knowledge Bases

Instead, you may open the support window on the trading website and conduct your study there. It acts as a web browser for the support section of the business.

The commonly asked questions the business receives from users are addressed in bite-sized pieces that are part of one of Bybit’s several knowledge bases. The support centre also includes FAQ sections for popular topics like API and basic Bybit trading themes.

Visit Bybit Learn if you are starting. Many crypto-related issues, including decentralised finance, blockchain, and altcoins, are covered in the literature. You may input keywords in the built-in web browser to locate the desired information fast. You may use its dictionary to get acquainted with the most common crypto jargon and terminology.

The Contract Info section on the transaction webpage might help you learn more about the product. That is the location you go to find out how each contract operates. Visit the Bybit Blog to keep up with the most recent cryptocurrency news.

You can provide feedback to Bybit if you wish to express your ideas. It lists each suggestion it has embraced chronologically on its User Feedback website. Many Bybit reviews demonstrate that the business genuinely cares about its customers and responds to complaints fast.

API Documentation and Community Support

Software developers can use the official API resources provided by Bybit. Also, the business runs several social forums where you may share ideas with other experts and report problems. It provides an email address for Technical help and a Messenger API chat room.

Authenticity Checker

The Authentication Check can assist you in confirming the accuracy of any information you have heard about the business, its platform, or its goods. It’s a member of the Bybit products designed to guard you against unethical behaviour.

Bybit vs BitMEX

Naturally, there are rivals in this market. One of them is BitMEX, and there are many areas where the two sites are similar.

Bybit and BitMEX provide perpetual and futures agreements and facilitate trading options with a maximum of 100x leverage. Maker rebates, BitMEX trading costs, and Bybit transaction fees are all the same. To further increase security against hackers, both cryptocurrency derivatives trading platforms employ multi-signature cold wallets.

BitMEX differs from Bybit because it chooses to pay all gains and losses in BTC, even when purchasing non-BTC contracts and not impose withdrawal fees. Bybit provides additional versatility, mainly if you trade using ETH, XRP, EOS, or USDT.

Despite the fixed Bybit transfer costs, taking money from your BTC account might cost you 0.0005 BTC, which adds up over time. Ultimately, it will be more expensive for you to maintain your assets in self-custody.

The primary difference between these two is user identification verification. As one of the first cryptocurrency exchanges to adopt a KYC procedure, BitMEX takes satisfaction. Yet, Bybit is more concerned with the IP address than the real identity of its subscribers.

Both businesses blacklist users in terms of user limitations based on their physical locations. Users from the States, Quebec, North Korea, Crimea, Cuba, Sevastopol, Iran, Syria, and Sudan are prohibited from using Bybit and BitMEX.

Moreover, Bybit doesn’t entertain Singapore, the UK, or China’s mainland residents. BitMEX accords Bermuda, Seychelles, and Hong Kong merchants with the same treatment.

Bybit vs Binance

Compared to Bybit, Binance’s ecosystem is larger and more sophisticated.

You may trade, utilise, store, and purchase cryptographic assets on Binance. It lets you buy cryptocurrency at spot rates and engage in margin trading. On this platform, you may trade liquid swaps, trade leveraged tokens, buy and sell assets openly from other users, futures agreements, and more.

Binance also acts as a springboard for initial exchange offerings and has an architecture impact fund to sponsor blockchain initiatives.

You can only trade on margin on Bybit. Yet, it could follow Binance’s lead because it’s still a new platform.

The two platforms resemble each other in various ways regarding making and receiving payments. Each demands a minimum purchase requisition when purchasing crypto assets; however, neither has a deposit cap.

Binance has the same withdrawal price for BTC as Bybit (0.0005%), while Bybit costs twice as much (0.005% vs. 0.01%) for ETH withdrawals. The standard Bybit trading charge is 0.075%. Only when you are using BNB on Binance can you receive this rate. Alternatively, be prepared to lose 0.1% of each deal.

Binance also makes it possible to buy 23 cryptos, including its native coin, Binance Coin. By contrast, only three of the five assets that Bybit offers you wallets for may be purchased with fiat currency. Moreover, it lacks a proprietary cryptocurrency.

Whereas Bybit restricts users to 12 locations, Binance limits investors from up to 48 countries. Hence, depending on where you’re based, you may have to choose between the platforms.

Suppose you’re given the go-ahead to use Bybit or Binance.

In that case, you can count on both platforms to offer robust security measures, a variety of deposit alternatives, dependable customer service, and self-help facilities.

Can I Stake Cryptocurrencies on Bybit?

Yes, With four distinct staking kinds, Bybit offers the broadest range of staking possibilities internationally. See the list below for a quick summary of the many earning choices on Bybit. Experts advise reading the markets Earn site to discuss Bybits staking thoroughly.

- Bybit Savings: With returns up to 180%, Bybit Savings allows you to stake 22 tokens, including BTC, ETH, USDC, USDT, and ADA, on both fixed and flexible and term contracts.

- Liquidity Mining: These are liquidity pools centred on the automatic market maker paradigm. You may contribute liquidity to generate a yield from trading commissions and add more leverage to grow your part of the pool and raise your profits. All 15 collections are double-sided and coupled with USDT. Yields vary between 3% and 50% APY.

- Dual Asset: Short-term, fixed-term staking choices with durations of 1, 3, or 5 days on double-sided USDT staking on 28 various tokens. With a whopping APY of up to 450%

- Shark Fin: A staking product with a primary guarantee that enables you to profit from the increase or decrease in volatility for particular coins.

Bybit Rewards Hub & Bonus

Bybit gives its members a robust rewards and incentive system with several weekly promotions via their social media and blog platforms. They first offer a rewards centre where users may do easy activities and get incentives worth up to USD 4000.

They feature a Promotions area on their Bybit Blog with new operations every week in addition to the rewards centre.

As if that weren’t enough, they additionally offer a referral program via which customers may receive incentives of up to $420 for each person they introduce to the exchange.

What are BIT and BITDAO

One of the most prominent decentralised autonomous organisations is BitDAO (DAOs). The governance token in the BitDAO system with a proposal and vote power is called BIT. The project aims to create a decentralised, open-access, tokenised economy. It is a platform that BIT token owners run.

By creating BitDAO DeFi goods and providing financial assistance to DeFi partners and initiatives, BitDAO will distribute funding to expand the DeFi ecosystem. Moreover, they could give money to BitDAO contributors for projects like community management campaigns, creating a custom governance module, or the upcoming BitDAO foundation.

The project will support these programs so everyone in the neighbourhood gains from them. All choices will be made via the BitDAO voting and proposal mechanism.

How To Participate In BitDAO (BIT) Project?

By contributing to the project, partnering with it, or holding tokens, anybody may join the BitDAO community.

Community Members

Non-token holders can join their discussion and social network platforms and submit suggestions. The good suggestions put forth to BIT token holders are welcome. Community leaders may get votes on their behalf.

Contributors and Partners

Any CeFi or DeFi initiative that can aid BitDAO or is prepared to look for ways to collaborate can do so.

Token Holders

Owners of BIT tokens control the platform and may vote and suggest changes to BitDAO’s expansion plans and the use of its treasury resources.

How Does BitDAO (BIT) Work?

BitDAO is governed and run by BIT token owners. It functions via the DAO technique, as shown below.

Crypto projects frequently use the DAO governance structure. The DAO framework enables BIT token owners to influence BitDAO operations through a concept and vote process.

Only if a proposal and vote on the DAO platform are successful will the following actions be taken:

Only if a proposal and vote are thriving on the DAO system will the following actions be taken:

- Development teams and R&D facilities will get funding or milestone incentives for producing BitDAO solutions or supporting partner goods.

- The core protocols of BitDAO will be updated, especially those related to governance and treasury administration.

- Token exchange functionality will be offered for both ongoing and new projects.

- Several strategies will be used to allocate Treasury monies.

- Projects involving blockchain technology, educational initiatives, and other bitcoin services will receive grants.

- Initiatives from partners will receive support in terms of monetary flow.

Governance Token (BIT)

The governance token of BitDAO BIT is an illustration of a governance token from Compound Finance (COMP). Due to the availability of delegated voting, off-chain vote aggregation, and the potential to transition to on-chain administration, this was chosen over a standard ERC-20 coin.

Delegated Voting

Only when their right to vote is transferred to an address can BIT holders vote or submit suggestions. You can make a single instance of delegation to a specific address, like the holder’s own.

Delegation does not lock or transfer tokens. It suggests that the BIT coins are recovered and that the BIT owner can delegate them to a different address if a delegatee wallet is taken over, compromised, or associated with the incorrect smart contract.

NFT Marketplace

Users may purchase, sell, and exchange Non-Fungible Tokens (NFTs) on the Bybit exchange directly through the Bybit NFT Marketplace. Collectibles like digital art, limited-edition video game products, and event tickets are examples of Bybit NFTs. Using unique cryptographic IDs in each token, users may confirm the ownership and legitimacy of their NFT assets.

Users can purchase unique and exclusive tokens by participating in special events like auctions and restricted drops and buying and selling NFTs. However, it only supports well-known NFT projects you could discover on famous sites such as OpenSea or Rarible.

Conclusion

Bybit is one of the few exchanges that provide up to 100x leverage and is by far the most popular futures trading system in the world. Also, investing in cryptocurrency is beneficial for people who want to avoid validating their identity. Also, Bybit is accessible in more than 180 nations worldwide.

One of the most incredible things regarding Bybit is that the exchanges prioritise customer retention over client acquisition. They demonstrate this by developing several marketing and incentives to encourage user trading. Overall, it’s an excellent exchange for seasoned traders and total newbies to cryptocurrency.

FAQs

Can Bybit Be Trusted?

Yes, Bybit is a trusted platform. A bitcoin futures exchange with a comprehensive selection of cutting-edge trading tools is called Bybit. It promises no downtime but is not offered in the United States. Find out if they are perfect for you by reading their full review.

Should I Use Bybit Or Binance?

When comparing the total scores of two cryptocurrency exchanges, Binance and Bybit, Binance has a better score of 9.8, and Bybit has a score of 9.1. If we compare the ease of use between Binance and Bybit, it is evident that Binance offers a better and more streamlined customer experience than Bybit.

Do People Make Money On Bybit?

You may also earn money on Bybit by signing up as a P2P trader and receiving commissions for advertising every two weeks. Create a Bybit account, post at least one or two adverts, one of which must sell at least 300 USD, and you’re ready to start accepting payments.

Are Bybit Fees High?

Bybit has one of the lowest trading costs among the biggest cryptocurrency exchanges. The platform is renowned for offering various derivatives and futures instruments. The maker and taker fees for futures trading are approximately 0.06% and 0.01%, respectively.