If you desire the best in Australian cryptocurrency exchanges, you’ve got a variety of alternatives available. Besides, there are more unfolding every month in 2023.

In the last few years, we’ve examined over 80 cryptocurrency exchanges, considering variables such as accepted currencies, fees, simplicity of use, security, and other aspects.

We’ve also performed the necessary research to identify the most acceptable cryptocurrency exchange in Australia.

In this review, you’ll have a better understanding of the best Reddit cryptocurrency trading platforms in Australia and how you can select a crypto exchange.

Best Cryptocurrency Exchanges in Australia for 2024 According to Reddit.

These are the best cryptocurrency exchanges, according to our reviews:

- Swyftx – Best crypto exchange in Australia ($20 BTC sign-up bonus)

- Coinspot – Well known Australian cryptocurrency exchange

- Digital Surge – New Australian crypto platform with a great team

- Binance – Best cryptocurrency trading platform for advanced users

- CoinJar – Oldest Australian crypto exchange

- Independent Reserve – Great Australian exchange for OTC purchases

- Coinbase – Biggest international crypto-exchange for beginners

- Coinmama – An international crypto broker with great payment options

- eToro – Best for CFD crypto trading

- Kraken – The best secure international exchange

1. Swyftx Exchange

Swyftx is the most excellent cryptocurrency exchange in Australia. It is registered under AUSTRAC and is based in Milton.

The platform provides over 200 cryptocurrencies that users can trade against AUD, USD, and BTC. This implies that newbies won’t be bothered about using cash for cryptocurrency on other platforms.

Swyftx’s fees are among the most reasonable in the business. The trading charge is a minimal 0.6 percent, and there are no fees for transactions—Swyftx charges between 0.2 and 0.8 percent, compared to the average industry margin of 5.2 percent.

Swyftx, being a fully licensed exchange, adheres to AML and KYC rules. To shorten the time of the first KYC, the platform employs transaction tracking systems, allowing customers to complete the registration and verification procedure within two minutes. Finishing the KYC check entitles you to a daily deposit maximum of AUD 20,000.

The service plays an active role to safeguard your account by utilising 2FA and compromised password identification, in addition to professional penetration testing regularly.

2. CoinSpot Exchange

CoinSpot is an Australian cryptocurrency initiated in 2013. Because of its user-friendly layout, this platform is a preferred starting point for traders, attracting novice and expert traders.

The exchange accepts various cryptocurrencies, including the most well-known, like Bitcoin and Ethereum, and even the lesser-known altcoins.

POLi, PayID, BPAY, cash, and direct deposit/bank transfer are acceptable deposit options. For bulk transactions, corporate traders are also invited to use CoinSpot’s OTC desk.

The platform has only one disadvantage: it’s the most expensive cryptocurrency exchange available, with somewhat higher costs than the industry average.

The charge for purchasing, selling, and exchanging cryptocurrencies is 1 per cent. Besides, you also get similar charges on the buy stop, Stop-loss, and buy limit orders.

Furthermore, to have a registered account, you must present a photo of your state ID together with a scanned copy of a utility bill to confirm your residence. CoinSpot is well-known for its excellent customer service, owing to its team’s quick response to consumer inquiries.

3. Digital Surge Exchange

Digital Surge, situated in Brisbane, is the latest trading platform in Australia, created in 2017. It was formed by IT specialists Dan Rutter and Josh Lehman.

The service has strongly emphasised service delivery and simplicity of use, shown on their platform. It is an excellent exchange for both new and experienced users.

Fortunately, the exchange accepts POLi, PayID, OSKO, and BPAY, giving you a broad choice of depositing options. Moreover, they offer the Digital Surge PayWizard—enabling users to process payments using Bitcoin.

The standard price for Digital Surge is 0.5 per cent but can fall as low as 0.1 per cent, dependent on trade volume. Other payment options have a fee ranging from $2 to $3.30, and the minimum payment options have a price ranging from $2 to $3.30.

As per their webpage, Digital Surge is a member of AUSTRAC and is entirely compliant with AML and CTF.

4. Binance

Binance is yet another worldwide platform that, despite its 2017 inception, has won the attention of millions of traders worldwide, leading to (hence the massive trading volumes there).

Binance was founded in China, after which it migrated to Malta—a favourable Island for cryptocurrency exchanges because of regulatory hurdles.

The platform is known for the wide range of cryptocurrencies it provides. Traders that are willing to take a risk can invest in the most esoteric but possibly valuable tokens. They can also participate in margin trading when they are confident in their trading abilities.

Binance is widely regarded as the most excellent crypto exchange for sophisticated traders; what’s more, they have an indigenous coin called BNB that traders can use to receive a 50% discount on trading costs.

Binance has been lauded as an exceptionally trusted network that goes above and beyond to provide top-tier security measures for its clients’ cash.

The Secure Asset Fund for Customers (SAFU), which operates as a pooled vault to which Binance allocates 10 per cent of all collected fees, is the system’s most distinguishing feature.

When the site was hacked in May 2019, Binance was sufficient to repay its users by withdrawing money from SAFU.

5. CoinJar Exchange

CoinJar became Australia’s first cryptocurrency exchange, launched in 2013.

It was founded in Melbourne and subsequently registered as a UK cryptocurrency exchange. Since its establishment, the company has rapidly grown and spread internationally.

The market has been at the vanguard of several amazing technical breakthroughs, such as the CoinJar card (powered by Mastercard), which allows you to spend your cryptocurrency as cash.

The platform supports more minor Cryptocurrencies compared to other exchanges on our listing. However, they accept a variety of deposit options like BPAY, PayID, Blueshyft cash transactions, and bank transfers.

The CoinJar Bundles service also accepts debit cards. The bundles enable you to select a package of Cryptocurrencies that you may regularly acquire to gain access to a wide variety of cryptos, which is ideal for novices.

For purchase and sell orders, CoinJar charges a flat cost of 1 per cent. But, depending on transaction volume, you can reduce such costs to 0.05 per cent.

The CoinJar crew is fantastic and widely praised online. It is a tremendous exchange for novices, but it also provides excellent features for expert users.

6. Independent Reserve Exchange

Independent Reserve, being the third crypto marketplace on our ranking, is also based in Australia and has been a model of success for cryptocurrency trading as of 2013.

It endorses 13 cryptos, such as Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and Ripple, and promising potential altcoins such as EOS, XLM, BAT, GNT REP, OMG, 0x, and PLA.

The payment options accepted by the exchange include EFT (bank transfer), Osko, SWIFT, PayID, and POLi, among others. You can choose between AUD, USD, and NZD. The fees begin at 0.5 percent and could go as low as 0.05 percent based on your trading volume.

When you obtain a Premium account, you’ll have complete security on your cryptocurrencies, protecting your performance against a violation of IR’s security, embezzlement, or theft of cash from your IR Bitcoin wallet.

We suggest the exchange to professional traders because it has a slight learning curve.

IR employs offline, multi-layer encryption for your money and saves them in cold storage, consisting of offline digital hardware storage systems in secure vaults around the country.

7. Coinbase

Coinbase is a well-known American brokerage that was founded in 2012. It is a Money Service Company registered with FinCEN and has received various licenses from reputable regulatory agencies.

Because of its user-friendliness and easy-to-navigate layout, Coinbase is the first option of crypto investors worldwide, particularly for newbies.

The exchange does not significantly improve the efficiency of other currencies, except the top cryptos like Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

It also has a rigorous Digital Asset Framework that evaluates each currency’s performance measures such as market capitalization, liquidity, consumer demands, and velocity before choosing to support the coin or not.

For minor investments, you can pay with a debit card, significant investments with a credit transfer, or both with a checking account. The network charges higher trading costs (1.49 percent to 3.99 percent).

The exchange does not significantly improve the efficiency of other currencies, except the top cryptos like Bitcoin, Ethereum, Bitcoin Cash, and Litecoin also provide excellent account security.

You can easily activate one of three forms of 2FA: a withdrawal whitelist, a Coinbase wallet, or a vault. Any confidential data held is adequately secured, and money is held in cold storage.

8. Coinmama

Coinmama has been in business since 2013 and has evolved into a popular and trustworthy cryptocurrency exchange.

Their website is incredibly user-friendly, allowing customers to purchase the leading cryptocurrencies using many payment methods such as bank transfers, debit cards, credit cards, and so on.

Although they do not offer a complex trading system like Swyftx or Binance, through Coinmama, you can simply purchase your chosen currency. Their customer service is similarly outstanding, providing alternatives like support tickets, email, and live chat.

Furthermore, it’s a worldwide platform, with over 180 countries serviced get fees. The service does not include the 5 per cent service charge in the asset’s value when displaying it.

Therefore, consumers are frequently surprised when making the most significant factor behind their costs, including debit/credit card fees and crypto exchange fees in orders.

There should also be an additional coin accessible, as they now only have eight coins available.

In conclusion, Coinmama is a good exchange: however, it lacks an advanced trading system and has exorbitant fees that detract from their ranking in our analysi

9. eToro

eToro was formed in 2006—it is well-known for its copy-trading system, which allows traders to replicate the trading techniques of other investors across 2000+ financial assets such as CFDs, equities, ETFs, stocks, cryptocurrencies, and many more. This is highly beneficial for new traders who have no prior trading expertise.

Do you want to try out margin trading, leverage, or shorting? eToro is an excellent place to start.

They have a lot of experience and are diligent in their work. It is evident through their user-friendly system and the security procedures they employ—2FA, cold storage, and SSL encryption.

eToro is regulated by the Australian Securities Investment Commission (ASIC) regulates eToro AUS Capital Pty Ltd. For customer service, there are two alternatives: live chat or support tickets.

It’s essential to have in mind their daily fee operation; you simply go to their website.

Note: If you don’t sign in for more than 12 months, you’ll be charged a $10/month inactivity fee.

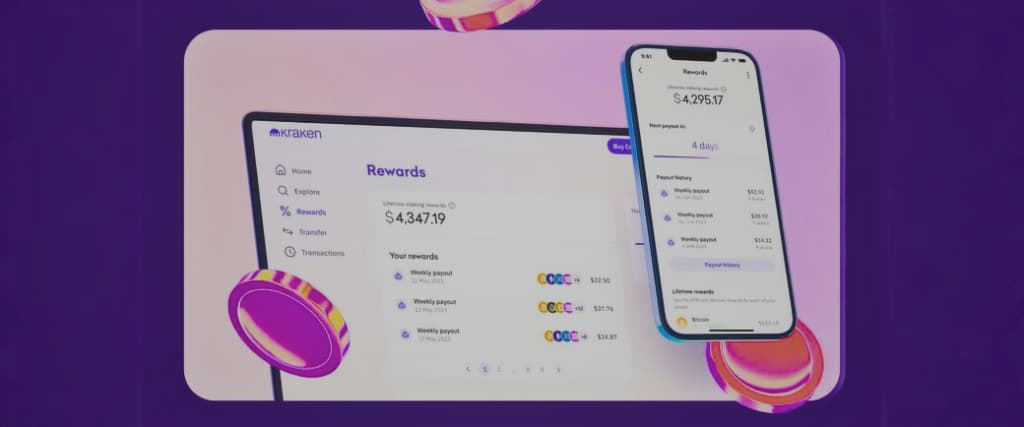

10. Kraken

Kraken is a reputable crypto exchange founded in 2011 by Jesse Powell. It accepts traders from all nations, including most US states.

The platform offers futures and margin trading and because of its advancement, experienced, and professional dealers feel perfectly comfortable on the platform.

They support over 50 cryptocurrencies and can also function with various fiat currencies: USD, CAD, GBP, YPY, EUR, AUD, and CHF.

Their costs are reasonable, ranging from 0.26 percent to 0.26 percent. This implies that exchanging AUD with another fiat currency will not cost you additional fees.

When it comes to security measurements, Kraken currently plays an influential part and keeps the majority of its money offline. Moreover, they have a bug reward program if an individual finds an exploitation or security issue.

Furthermore, if you want to take a brief vacation from trading, you can protect your account by enabling Kraken’s Global Settings Lock and Master Key, which prevent illegal account modifications.

Kraken also features a highly user-friendly smartphone app for trading on the fly.

11. KuCoin

Kucoin was established in 2017, and it’s one of the most recent crypto trading systems on this listing.

They’ve gone a long way since its beginning and have established themselves as a dependable exchange. They are also constantly expanding their service with additional features and currencies.

Currently, the number of pairs available is pretty impressive, and they’ve also introduced several innovations to keep the professional traders pleased. They provide futures and margin trading, as well as borrowing and staking. In other words, KuCoin is doing its hardest to suit every sort of investor.

Furthermore, their futures trading area offers a novice portion and a professional section for their traders. Just like other platforms, they offer a mobile app. It’s simple to use and attractive.

In terms of fees, they’re determined to make them affordable—often, the trading costs are around 0.1 per cent.

They also accept a wide array of payment options such as PayPal, credit/debit card, bank transfer, and so on. It’s usually positive when a company accepts more than twenty different fiat currencies.

12. Bittrex

Bittrex was created in 2013 by an ex-Microsoft staff. They began in Las Vegas, moved many times, and currently have their headquarters in Liechtenstein, where they have been renamed as Bittrex Global.

The essential advantage of this crypto exchange is its dedication to security—they’ve not lost a penny and retain 80 per cent or more of all money offline.

What’s more, they follow AML and KYC standards and have established a program called Know Your Transaction (KYT), which monitors exchange transactions and searches for unusual tendencies. The system then alerts the team if it finds anything unusual.

Bittrex’s marketplace is cutting-edge, with all the attractive additional features. You can transact fiat currencies such as USD, GBP, JPY, and EUR. They also accept a large number of coins—with charges at 0.2 per cent.

How to Choose a Cryptocurrency Exchange

You should compare the enumerated crypto exchanges for newbies to identify the alternative suitable to your purpose, knowledge, and expectations from cryptocurrency exchanges. When selecting the best cryptocurrency exchange, there are several important factors to consider.

Type of Trading

First, consider the type of exchange you’ll end up making and make sure your preferred exchange supports it. Typically, the following types of trading are available:

- Crypto-to-crypto trading

- fiat-to-crypto trading

- Both

If you want to buy crypto with Australian Dollars, for example, you should look for a crypto brokerage service that allows this type of crypto-to-fiat trade as well as your preferred payment method (bank transfer, credit card, etc.).

Otherwise, find a trading platform that offers direct crypto-to-crypto swaps if you want to trade crypto coins you already own against other cryptocurrencies (for example, BTC to ETH). Fortunately, most cryptocurrency exchanges do.

User-Friendliness

Crypto exchanges vary significantly in how they showcase their goods and services to the user, and different types of layouts are best suited to traders of different skill levels.

Some have an uncluttered and intuitive user interface, which makes novices feel at ease when conducting their first cryptocurrency transactions.

Experienced traders, on the other hand, look for a cutting-edge layout that provides detailed insight into market indicators, charts, candlesticks, and graphs, as well as everything else that can contribute to better trading strategies

However, for complete beginners, starting with an advanced trading platform can be discouraging.

Supported Cryptocurrencies

Before deciding on a cryptocurrency exchange, it’s a good idea to know what kind of cryptocurrencies you intend to purchase. Although over 4,000 altcoins are in circulation, some exchanges only accept BTC.

Nevertheless, a large percentage of them provide BTC as well as a basic selection of the most popular crypto such as Bitcoin Cash (BCH), Ethereum (ETH), and Litecoin (LTC).

It is difficult to find a trustworthy exchange that accepts unpopular and newly discovered coins, as these are less trustworthy.

If you trade crypto with fiat money, make sure the exchange has a list of your preferred currency in its present fiat-to-crypto trading pairs.

Deposit & Withdrawal Methods

Today’s cryptocurrency exchanges strive to reach a wider audience, so many deposit options are diverse. Most exchanges accept regular bank transfers and credit/debit cards, but some offer various e-payment options based on geographical availability.

Check to see if your preferred exchange:

- Deposits and withdrawals in Australian dollars are accepted.

- Has a deposit/withdrawal limit on a daily or monthly basis

Trading Fees and Exchange Rates

The fee structure is maybe the most varied element across cryptocurrency exchanges. However, all cryptocurrency exchanges charge almost the same fees: trading, withdrawal, and deposit fees.

Other exchanges, for instance, do not charge for deposits yet impose significantly greater trading costs than the standard. As a result, you’ll need to assess the overall cost and choose something worthwhile.

Please understand that the buying price of cryptocurrency does not have a uniform rate. It is computed based on recent supply and demand. Therefore an essential the price of cryptocurrencies can vary by up to 10-15 percent between exchanges.

Account Verification Process

When trading Bitcoin, some individuals choose not to reveal any personal information.

Nevertheless, complete anonymity is practically hard to achieve today owing to the stringent laws regarding Anti-money laundering and Combating the Financing of Terrorism(AML/CFT) that cryptocurrency exchanges follow.

In any event, a trade that follows local rules is more likely to be reliable.

Therefore, be prepared to invest your additional time in KYC (know-your-customer) validation before dealing with all the other well-established sites.

In actuality, the verification procedure differs depending on the exchange, but some of the credentials you’ll be required to provide include:

- Name

- Email address

- Mobile number

- Obtain a utility bill to verify your address.

- A copy or photograph of a govt document, such as an ID card, driver’s license, or passport.

Keep in mind that certain exchanges have different verification levels that impact the transaction limits and services available on their system. The more private details you supply, the more trade opportunities you have

Security Features for Both Wallets and the Platform

In the digital realm, security takes precedence over anything else. Generally, cryptocurrency exchanges have a record of unsolved hacking assaults that have resulted in millions of dollars in irreversible losses.

As a result, you’ll realize that they make a concerted effort to integrate the most excellent security requirements in their systems, customer accounts, and wallets.

Have the following in mind when evaluating the aspects of the exchanges:

- Two-factor authentication(2FA)

- The storage of clients’ funds, whether offline or online

- Management of the secret keys of clients

- The type of verification needed

- Account activity alerts through emails and SMS

- Constant security surveillance

- Email encryption

- Proof of reserve

Customer Support

We always underrate the “customer-support” factor. Still, the truth is that most user complaints come from the inability to reach the support team and get prompt assistance regarding account verification or transactions.

When inspecting a platform’s customer support, focus on:

We often underestimate the importance of customer service. Still, the reality is that most of the complaints from customers stem from being unable to contact the support staff and receive assistance with verifications or transactions.

You need to pay attention to the following when examining a network’s customer service:

- What means can you use to contact the support staff?

- If a phone line is available, do they use a machine to answer the most commonly asked queries, or do they speak to you directly?

- Is the assistance service just available between business hours or 24 hours a day, seven days a week?

- How soon does it usually take to receive a response?

- Is there English assistance for globally listed exchanges?

- Is there a help area on their webpage?

Reputation & Reviews

What do the internet reviews say about the platform? Individual observations are often the most dependable source for learning the platform’s factual flaws and benefits.

Rating systems are pretty valuable for determining if a platform can be trustworthy.

Additionally, you should also learn more about the firm’s background, how long it has been in business and whether it has past cybersecurity incidents.

Is It a Regulated Exchange in Australia?

Local governments worldwide appear to have been taken off guard by the crypto industry’s quick rise. They are working hard to establish specific legislative frameworks, but most nations still do not achieve the intended result.

In Australia, crypto businesses must be registered under the Australian Transaction Reports and Analysis Centre and adhere to the AML/CTF requirements of the authorities.

Due to local legislation, certain exchanges are restricted from other nations, while others do not permit users from specific areas. Luckily, Australia does not appear on these lists.

Cryptocurrency Exchange Types

Investors use the term exchange to refer to various crypto markets, such as cryptocurrency brokers, trading platforms, and other services.

The following exchange kinds are designed for a specific category of users based on their level of experience:

Cryptocurrency Broker

Crypto brokerage services are intended for newcomers who have no prior experience with cryptocurrency trading. They have streamlined the purchase procedure to the point that anyone with a computer may acquire some cryptocurrency in a few clicks.

Fortunately, all cryptocurrency exchanges accept fiat currency. CoinSpot is an excellent example of a beginner-friendly brokerage where newcomers can learn the ropes and be encouraged to keep trading.

Crypto Exchange for Trading

Standard trading platforms are still not inherently inaccessible to beginners, but they go beyond simple crypto brokers.

More precisely, on trading platforms, you may buy, sell, and trade bitcoin on an international market for lower costs, select a trading pair from a wide variety of authorized cryptocurrencies and engage in more complex choices like margin trading.

The UI of the platforms often includes essential trading tools and market indicators. Binance exemplifies the interface of a user-friendly system.

Crypto CFD Provider

Contract For Difference(CFD) providers give skilled traders a rather intricate and advanced technique to trade cryptocurrencies. CFDs are a comparatively recent subject in the crypto world, although they have long been present in the stock and currency markets.

The difference between conventional cryptocurrency trading transactions and CFD trading is that you do not truly own the coin. Instead, you only use CFDs to bet on the underlying coin’s price and profit if it moves in the way you expected.

Futures & Derivatives Crypto Exchanges

Derivatives are likewise aimed at experienced traders and are sometimes referred to as the “next level” of cryptocurrency trading.

Derivatives, in a nutshell, are secondary contracts that draw their value from a main underlying asset.

Futures are the most common crypto derivatives, contracts to purchase or sell a digital currency later for a predetermined price.

Traders use them to lock in profits in a turbulent market or hedge their present positions.

A rising number of regular cryptocurrency exchanges provide derivatives on their platforms, but some derivatives and futures exchanges are expressly developed.

Best Cryptocurrency Exchange List

Best Crypto Exchange to Buy Bitcoin

A good Cryptocurrency exchange does not need to provide a wide range of trading features because people are only there to buy Bitcoin.

As a result, the best Bitcoin exchange must be affordable, simple to use, and offer a diverse range of fiat payment options.

With both in mind, the ideal solution is to use a local exchange since you can be confident that the platform will endorse your currency value and that you will not be charged any extra charges for cross-border exchanges or conversions.

Swyftx is the best Bitcoin exchange for Australians based on these criteria. It is a reliable trading location, and its fee structure is in line with the industry norm.

When it comes to purchasing Bitcoin, the exchange provides first-rate services for quick and straightforward transactions. Furthermore, bank transfers, PayID, OSKO, and debit/credit cards are perfectly adapted to the Australian market.

Best Crypto Exchange to Buy Ethereum

Ethereum, also known as Ether (ETH), is the second-largest cryptocurrency, available on any cryptocurrency exchange that isn’t solely focused on Bitcoin.

This means that the best Ethereum exchange criteria should be similar to those for choosing the best Bitcoin exchange – low fees, local availability, high liquidity, and quick transactions should all be considered.

Swyftx is, once again, the cheapest place to buy Ethereum in Australia.

Best Crypto Exchange to Buy Altcoins

The best altcoin exchanges support a diverse range of cryptocurrencies and, ideally, offer adequate liquidity, low interest, and the ability to use your favorite payment method.

The best altcoin exchange is a tie between two companies based in different parts of the world.

Binance is still the undisputed best when it comes to the sheer number of cryptocurrencies available for trading, and they now have an Australian branch as well!

KuCoin is the second site users propose, a new-age exchange that offers various cryptocurrencies (around 400 pairs) and trading options, such as margin trading.

Cheapest Cryptocurrency Exchange

Low trading fees do not always imply that a platform has been the most cost-effective.

You must also consider transaction fees, the existing spread, and the currency’s exchange rate.

Even if you’re looking for instant fiat purchases or a way to trade cryptocurrencies, it all depends.

Swyftx is a popular platform for purchasing Bitcoin and other altcoins with fiat money. Although the exchange charges fees for deposits and withdrawals, you will get the best propagates on altcoin transactions.

Binance is the most cost-effective transfer for crypto-to-crypto trading, with trading fees of just 0.1 per cent.

Best Crypto Exchange With Low Fees

If you’re willing to take part in crypto-to-crypto buying and selling, or if you intend to start trading regularly, you should look for exchanges that charge the minimum trading fees per transaction.

Some exchanges use a flat fee system, which means they don’t charge differently depending on whether you’re a taker or a creator. Creators always pay less on others who incur different charges.

Binance has one of the lowest charges of any exchange, with a fixed fee beginning at 0.1 per cent. CoinJar differentiates between 0.15 per cent and 0.20 per cent makers and takers fees, respectively.

Best Crypto Exchange With Zero Fees

Don’t be taken in by zero-fee advertisements because they aren’t always accurate. However, it is essential to obtain transactions that do not charge for trades; however, this benefit is usually reserved for crypto-to-crypto derivatives.

For instance, KuCoin has recently introduced an Instant Exchange that provides the best cryptocurrency exchange rate possible, enabling quick coin exchange with no transaction fees. This service accepts popular cryptocurrencies like Bitcoin, Litecoin, Ethereum, and XRP.

Largest Cryptocurrency Exchange

Users usually compare the daily trading activity of cryptocurrency exchanges to determine how “large” they are. It is the essential indicator of cash flow and prestige.

Nevertheless, you should not rely on the numbers provided on popular but untrustworthy commercial websites like CoinMarketCap, as the crypto industry is notorious for wash trading and fake volume.

Fake results, on the other hand, are always discovered sooner or later.

Binance has long been the undisputed leader in trading volume and market capitalization, according to reputable sources such as the Blockchain Transparency Institute.

If the number of users measures the exchange size essential, however, according to Similarweb, the best cryptocurrency exchange in the world is Binance, with 39.4 percent of total web traffic for crypto exchanges in May of 2021.

Best Cryptocurrency Trading Platforms

Modern trades strive to provide a cutting-edge customer experience to attract a bigger audience. Elegant user interface solutions are necessary, but they are insufficient to create a fantastic crypto exchange system.

The ideal cryptocurrency platform must be very liquid and provide a diverse set of trading alternatives, including futures and options and margin trading.

Furthermore, it must also have built seamless connections with powerful tracking tools and bots, not to mention robust security standards and dependable customer service.

It’s not possible to rate the right platform depending on your specific trading needs. Binance, for instance, provides up to 125 leverage, Kraken provides the highest derivative chances, and eToro is excellent for CFD trades.

Cryptocurrency Exchanges That Don’t Require ID

Currently, complete anonymity is very hard to achieve.

In truth, there are distinct possibilities for anonymous crypto-to-crypto trading (mainly on peer-to-peer networks); however, the bulk of markets do demand complete ID verification if you prefer to purchase cryptos with fiat currency.

Although some exchanges enable you to open an account without verifying your identity, you’ll be confined to a certain amount of services and withdrawal restrictions as an unverified client.

P2P (peer-to-peer) trades such as Paxful are among the only crypto businesses that allow customers to trade without authenticating their identities.

Cryptocurrency Exchanges With Cash Payment

In Australia, you may purchase cryptocurrencies with cash in three ways: at a Bitcoin ATM, using Flexepin cash vouchers accepted by a small number of crypto exchanges like CoinSpot, or by searching for a seller who takes cash payments on a P2P exchange.

In addition to cryptocurrency exchanges, Bitcoin ATMs are a legitimate means to purchase Bitcoin (most BATMs allow purchases of other popular cryptocurrencies. Around 30 BATMprioritises are located throughout Australia’s major cities.

Coinmama is an excellent non-custodial cryptocurrency service.

Best Non-Custodial Cryptocurrency Exchange

Non-custodial cryptocurrency exchanges do not include a crypto wallet in their services.

Instead, they transmit the crypto assets to your wallet as soon as the transaction is completed. This is believed to be a safer alternative than giving the exchange complete authority over your cash.

A reputable non-custodial exchange will send the crypto you’ve acquired as quickly as possible and accept a variety of payment ways.

Coinmama is an excellent example of a reputable non-custodial crypto service.

Best Decentralised Cryptocurrency Exchange

Decentralised exchanges (DEXs) operate differently from traditional centralised exchanges since they do not function as intermediaries in the transaction process.

DEXs are still in the early stages of development and suffer serious liquidity, usability, and daily delayed transactions.

All of this is contingent on the blockchain network on which a DEX functions. In a word, blockchain networks are decentralised digital ledgers that allow users to transfer and receive bitcoin through nodes.

Waves, for example, is a multi-purpose DEX platform, but the vast majority of decentralised protocols rely on the Ethereum blockchain, which means they only accept Ether and ERC20 tokens. Balancer, 0x, Uniswap, Sushi, and the Kyberg Network are among them.

Best Crypto Exchange for Beginners

For easy and quick purchases, crypto newbies require an accessible interface that you can browse without a prior understanding of crypto trading.

On the other hand, Beginners want a basic brokerage service that allows them to purchase any cryptocurrency using their local or chosen fiat money.

Some well-known exchanges, like Coinbase, provide distinct interfaces for consumers with varying degrees of competence.

The user interface on the less-advanced Coinbase version is the most user-friendly.

Swyftx and Digital Surge are the most beginner-friendly cryptocurrency exchanges in Australia.

Best Crypto Exchange for Safety

Always double-check the security standards that a crypto exchange uses to safeguard its website, its users’ accounts, and their wallets if you’re looking for a reliable crypto exchange (if any).

A secure exchange also conforms fully with AML/CFT standards and local government rules. Additional security steps to be aware of include 2FA, appropriate asset storage in cold storage, email encryption, and so on.

On a worldwide scale, Kraken is regarded as the most secure cryptocurrency exchange, with no hacking assaults on its record.

Coinspot, Australia’s first local exchange to acquire the ISO 27001 accreditation for information security, is the industry leader in safety.

Best Bitcoin Trading App

Almost all respectable exchanges have released mobile applications that are free to download on Android and iOS smartphones. The most okay trading app has the same amount of functions as the browser-based platform.

Traders primarily utilize the mobile version of their preferred exchange to remain up to date on the most recent news and offers in real time. As a result, the trading app should be up-to-date and available in your home country.

We suggest the Swyftx mobile app in Australia, but you can’t go wrong with the Coinbase or Binance applications as well.

Frequently Asked Questions

1. How Do I Choose a Crypto Exchange?

You should analyse the features of a crypto exchange and compare them to your investment strategy if you want to find one priority right for you.

Consider the cryptographic protocol choice, payment methods available, as well as platforms with minimal charges and high transaction limits, user reviews to determine the level of customer service provided, and a history of successful security breaches.

2. What Is the Biggest Crypto Exchange?

Based on the platform’s trading volume, markets, and liquidity, Binance is the largest crypto exchange among the five mentioned above, according to influential crypto sites like CoinMarketCap.

3. What Is the Best Crypto Exchange in Australia?

Swyftx is the best cryptocurrency exchange in Australia. The platform’s extensive list of supported cryptocurrencies, high-level security methods, reasonable fees, and overall user experience influenced the decision. It’s also a user-friendly option that’s ideal for beginners.

4. What Is the Safest Crypto Exchange Platform?

Swyftx is the most secure option for Australians. Swyftx has the advantage of being based in Australia, in addition to cutting-edge security measures.

Users will benefit from the firm’s headquarters’ closeness and improved customer service.

5. Who Has the Most Bitcoin?

The mysterious creator of the world’s first and most popular cryptocurrency, Satoshi Nakamoto, owns the most bitcoins. He has about 1.1 million coins in his possession.

6. Why Are Bitcoin Fees So High?

As Bitcoin became more popular, the number of Bitcoin transactions grew proportionally. As a result, mining difficulty has increased, and miners are now prioritizing transactions from users who have included higher fees.

7. Where Do Bitcoin Transaction Fees Go?

Bitcoin transaction fees are a component of the miner’s reward for creating bitcoins and validating transactions.

8. Is Cryptocurrency Taxed in Australia?

The Australian government is making significant strides toward regulating cryptocurrency trading issues. Until 2017, Bitcoin and other altcoins were taxed twice in Australia under the Goods and Services Tax (GST), but they’re still considered property and are liable to Capital Gains Tax (CGT).

This implies that every profit you make from selling or buying crypto assets will be taxed like any other regular income.